Why is western Canada taking a bigger housing hit when Ontario has lost more jobs.

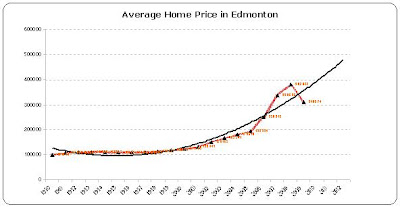

Taking a look at prices at a historical level we have seen the market appreciate at incredible levels since 2005. It’s hard to put in context that the Tiger Wood’s like years we have been having is not the norm. The home prices shot up too quickly because of the frenzy of buying since 2006. We are seeing a normal correction in a long term up cycle.

We need to get back to late 70's house prices for it to match peoples ACTUAL paychecks these days. Till then oh well, the price crash has just started.

Affordability of a home is a key measure of the health of the market. According to the RBC affordability index, which measures the average pre-tax income that goes towards housing, Edmonton is currently under 40%. This is at the historical norm. It should be taken into account that the affordability now is even better than it was over the past 20 years with the introduction of the 35 amortization mortgages.

No comments:

Post a Comment